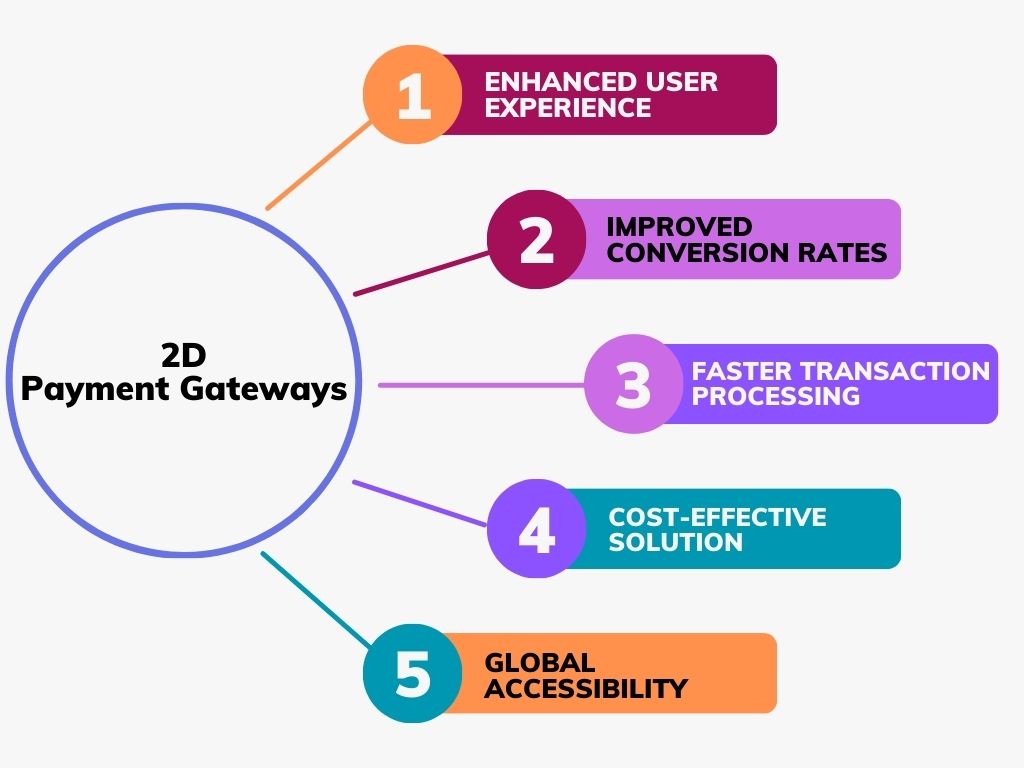

Leading Benefits of Carrying Out a 2D Payment Gateway for Online Sales

Leading Benefits of Carrying Out a 2D Payment Gateway for Online Sales

Blog Article

The Role of a Settlement Gateway in Streamlining E-Commerce Payments and Enhancing Customer Experience

The integration of a payment portal is critical in the ecommerce landscape, acting as a secure conduit between consumers and merchants. By making it possible for real-time deal handling and sustaining a range of repayment methods, these portals not just mitigate cart abandonment but additionally enhance total consumer satisfaction. Their emphasis on security and openness grows trust fund in a progressively competitive industry. As we discover the diverse advantages of settlement gateways, it becomes important to analyze just how these systems can additionally develop to meet the needs of both customers and organizations alike.

Understanding Settlement Portals

A repayment entrance works as a critical intermediary in the e-commerce deal procedure, facilitating the safe and secure transfer of settlement details between merchants and customers. 2D Payment Gateway. It allows on-line companies to approve different types of repayment, consisting of credit score cards, debit cards, and digital wallets, thus expanding their customer base. The entrance runs by encrypting delicate details, such as card information, to guarantee that data is transmitted firmly over the net, lowering the danger of scams and information breaches

When a client initiates an acquisition, the settlement portal captures and forwards the transaction information to the proper economic organizations for permission. This procedure is normally seamless and happens within seconds, giving clients with a fluid shopping experience. In addition, payment entrances play an essential role in conformity with market standards, such as PCI DSS (Repayment Card Sector Data Protection Standard), which mandates stringent protection steps for processing card settlements.

Understanding the mechanics of settlement gateways is essential for both vendors and customers, as it directly influences transaction efficiency and customer depend on. By making sure effective and secure purchases, settlement portals contribute dramatically to the general success of e-commerce organizations in today's digital landscape.

Secret Attributes of Payment Portals

Numerous crucial functions specify the efficiency of payment gateways in ecommerce, making certain both safety and security and benefit for individuals. One of the most crucial attributes is robust security procedures, including encryption and tokenization, which secure sensitive client information throughout transactions. This is essential in promoting trust in between customers and merchants.

Additionally, real-time purchase handling is essential for making sure that settlements are completed swiftly, decreasing cart desertion rates. Settlement portals also provide fraudulence detection tools, which check deals for suspicious task, more protecting both consumers and sellers.

Benefits for Ecommerce Companies

Numerous benefits arise from incorporating payment portals into shopping services, significantly boosting functional efficiency and client complete satisfaction. Settlement portals promote smooth transactions by safely refining repayments in real-time. This capacity reduces the possibility of cart desertion, as clients can promptly complete their acquisitions without unnecessary delays.

In addition, repayment portals sustain multiple repayment methods, suiting a diverse variety of customer preferences. This flexibility not only attracts a broader customer base however likewise promotes loyalty amongst existing clients, as they really feel valued when offered their preferred payment options.

Furthermore, the assimilation of a repayment entrance typically brings about boosted protection attributes, such as file encryption and fraud discovery. These measures secure sensitive consumer information, consequently constructing trust and integrity for the e-commerce brand name.

In addition, automating settlement processes with entrances minimizes hands-on workload for team, permitting them to concentrate on critical campaigns as opposed to routine jobs. This functional efficiency equates into expense financial savings and enhanced source allotment.

Enhancing User Experience

Integrating an effective settlement entrance is important for improving user experience in ecommerce. A seamless and effective settlement procedure not only develops customer trust however likewise decreases cart desertion prices. By supplying numerous repayment choices, such as credit scores cards, digital wallets, and financial institution transfers, services satisfy diverse customer choices, thereby enhancing complete satisfaction.

Moreover, an user-friendly interface is vital. Repayment gateways that offer user-friendly navigation and clear guidelines make it possible for customers to total transactions promptly and effortlessly. This convenience of use is important, particularly for mobile consumers, that need enhanced experiences tailored to smaller sized screens.

Security functions play a substantial function in individual experience. Advanced security and fraud discovery devices reassure clients that their delicate data is secured, fostering self-confidence in the purchase process. In addition, clear communication concerning policies and costs improves credibility and lowers possible aggravations.

Future Patterns in Payment Processing

As e-commerce remains to progress, so reference do the patterns and innovations forming settlement processing (2D Payment Gateway). The future of settlement processing is marked by several transformative trends that promise to boost performance and individual contentment. One significant pattern is the surge of fabricated intelligence (AI) and artificial intelligence, which are being significantly incorporated into repayment portals to boost safety with advanced scams detection and threat analysis

Furthermore, the fostering of cryptocurrencies is acquiring traction, with even more companies discovering blockchain technology as a practical option to conventional repayment methods. This change not only supplies lower purchase fees but additionally attract an expanding group that worths decentralization and privacy.

Contactless payments and mobile wallets are coming to Click Here be mainstream, driven by the demand for faster, much more convenient transaction techniques. This trend is further sustained by the raising frequency of NFC-enabled tools, allowing seamless transactions with simply a faucet.

Lastly, the focus on regulative conformity and data protection will form repayment handling techniques, as services make every effort to construct depend on with consumers while sticking to developing legal frameworks. These patterns collectively suggest a future where settlement processing is not only much faster and much more safe and secure however also extra lined up with consumer expectations.

Final Thought

To conclude, repayment gateways serve as essential elements in the shopping environment, promoting protected and effective purchase processing. By supplying diverse payment options and prioritizing user experience, these portals dramatically decrease cart abandonment and boost customer contentment. The ongoing evolution of settlement modern technologies and safety and security measures will certainly additionally enhance their duty, making certain that shopping organizations can meet the demands of significantly innovative consumers while cultivating count on and reliability in on the internet purchases.

By allowing real-time purchase processing and sustaining a variety of payment approaches, these entrances not only minimize cart abandonment yet additionally enhance overall look at here now client contentment.A repayment entrance offers as a critical intermediary in the ecommerce purchase procedure, assisting in the safe transfer of payment information in between merchants and customers. Repayment gateways play a critical role in conformity with sector requirements, such as PCI DSS (Settlement Card Industry Information Safety Criterion), which mandates stringent safety and security actions for processing card repayments.

A flexible payment gateway fits credit scores and debit cards, electronic wallets, and alternative payment techniques, catering to diverse consumer preferences - 2D Payment Gateway. Payment portals facilitate smooth purchases by securely processing payments in real-time

Report this page